World Tariff Profiles 2016 explores changes impacting international trade

Joint publication from ITC, UNCTAD and the WTO provides latest trends in trade measures and introduces a newly revised Harmonized System for classifying goods

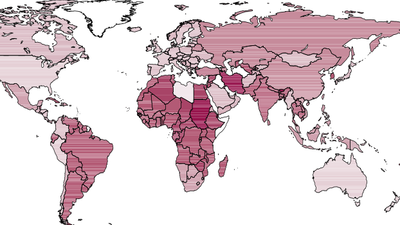

World Tariff Profiles 2016 provides a unique collection of data on tariffs imposed by WTO members and other economies. It is jointly published by the International Trade Centre (ITC), the World Trade Organization (WTO), and the UN Conference on Trade and Development (UNCTAD).

The report provides information on tariffs and non-tariff measures imposed by more than 170 economies. This year’s edition highlights two developments that will have a significant impact on the international trade community: the application of corrective trade measures and the newly revised Harmonized System (HS).

Application of corrective trade measures

The application of corrective trade measures concerns antidumping duties, countervailing duties and safeguards. These measures often make news headlines when their impact on a product’s final price exceeds Most Favoured-Nation tariff rates. These ‘temporary’ duties are frequently extended for many years and can form a long-term prohibitive trade barrier, influencing trade flows.

Some countries may use trade remedies as a form of retaliation in trade disputes, as we have seen in the recent application of antidumping duties on Chinese steel .At the same time, more and more trade agreements are including safeguard clauses to lessen the effects of trade diversion in sensitive industries. Given these applications, momentum is rising among African developing countries to build the legal expertise needed to deploy (or protect themselves from) these trade policy tools. ITC, in particular, provides support and data on these corrective duties through its Market Access Map.

Revised Harmonized System

Another important aspect in this year’s report is the recently revised Harmonized System (HS) classification for goods that will enter into force on 1 January 2017. HS is an international product classification introduced by the World Customs Organization and officially adopted by most WTO Members in 1988. Since its inception, the HS classification has been revised five times (you can visit ITC's product conversion table on Market Access Map, to learn how HS codes changed across different revisions).

Since its introduction, the HS has allowed trade operators in different countries to conform to a common way of referring to products, facilitating the work of customs offices and boosting worldwide trade. The 2017 version of the HS classification highlights the need for an increasingly precise terminology to define tradable products. The amendments are deemed to affect the designated product codes and descriptions of almost 15% of world imports.

The main drivers behind the changes can be categorized as: changes due to food security reasons; changes due to environmental and social concerns; and changes in manufacturing processes and technological advances.