The 2015 edition of the World Tariff Profiles is out!

This year’s joint WTO/UNCTAD/ITC publication explores the impact of tariffs in the changing landscape of global value chain fragmentation and growing trade in intermediate goods

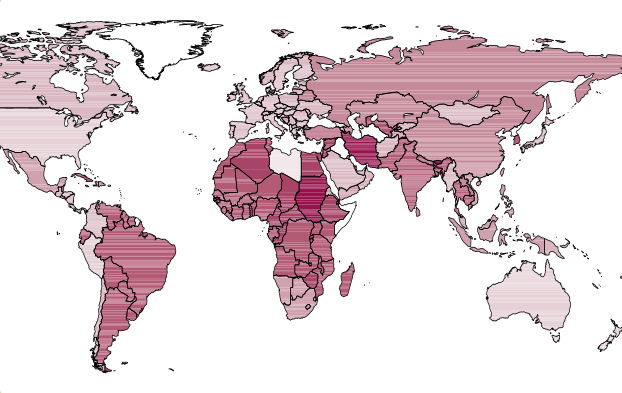

The World Tariff Profiles is an annual joint publication from the World Trade Organization, the United Nations Conference on Trade and Development and the International Trade Centre that provides extensive information on tariffs imposed and faced by the WTO’s 161 members plus a number of other countries and territories. Since 2014, it has also included information on antidumping data drawn from governments’ notifications to the WTO.

The special topic of this year’s report is the changing role of tariffs. With the steady decline in import duties resulting from many rounds of multilateral negotiations as well as regional and bilateral liberalization, the market access debate is rapidly turning to non-tariff measures. But could the impact of even modest tariffs be amplified by the fragmentation of global value chains and the associated increase in trade in intermediate goods?

Every year, ITC contributes to this publication through its unique collection of applied tariff data and calculations of so-called ‘ad valorem equivalents’ (AVE) for tariffs that are not levied as a percentage of the traded goods’ value. (To illustrate, a $1 per apple tariff on apples worth $1 each amounts to an ad valorem tariff rate of 100%.) Both the applied tariff information and the AVE data are sourced from an ITC database (MAcMap) and are available through the online application Market Access Map.

Market Access Map is part of ITC’s suite of market analysis tools free to users in developing countries thanks to generous support from the European Union, DFID, the World Bank and donors to ITC's trust fund. It provides up-to-date information on MFN and preferential tariff rates applied by more than 190 importing countries and faced by 239 countries and territories at the most detailed level. The tool also covers information on non-tariff measures (NTMs), certificates and rules of origin, anti-dumping, countervailing and safeguard duties.