Most Ethiopian exporters face challenges related to non-tariff measures

New business survey identifies obstacles encountered by traders and points to reform agenda

Ethiopia’s export sector has grown rapidly in recent years, but the country’s businesses would be performing even better in international markets were they not held back by an array of non-tariff measures (NTMs).

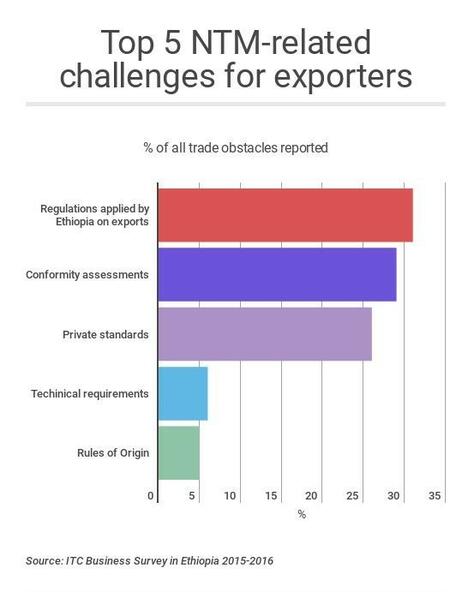

According to a new survey of Ethiopian exporters, importers and producers by the International Trade Centre (ITC), 96% of trading companies report difficulties related to the application and implementation of NTMs. Exports are much more affected than imports: 90% of exporting companies report facing burdensome NTMs, while only 56% of importing companies report such problems.

The NTM Business Survey focuses on six economic sectors: coffee, oilseeds, other agricultural products, textiles, leather products, and other manufacturing. Among them, leather products are the most affected by NTM-related obstacles.

The survey reveals as well that one-fifth of the export-related challenges pertain to technical requirements imposed either by domestic authorities or by trading partners. Product identity and quality requirements are the most frequent burdensome situations cited by businesses.

For agricultural products, these regulations define thresholds such as the percentage of coffee beans that may be broken beans or the amount of pesticide residue beyond which a food would no longer be deemed safe for consumption. For manufactured products, these regulations may impose limits on the use of chemical inputs, such as chromium and sulphur in shoemaking, for instance.

These regulations are designed to protect the health and safety of consumers. For exporters, however, meeting these requirements, and obtaining related certification, can be costly and time-consuming. The surveyed businesses report that much of the compliance burden is rooted in the processes of obtaining necessary paperwork, delays in inspections, the lack of testing and certification infrastructures in the country and the imbalance between the poor quality of local inputs and the high quality demands of the international markets.

Many export-related obstacles can be addressed at home

Many of the obstacles reported by Ethiopian traders relate to domestic policies and procedures. The Ethiopian government is thus in a position to address these obstacles by acting domestically.

For instance, Ethiopian export regulations, such as export clearance procedures, are pointed to by exporters as a major hurdle to trade. Traders also point to the multitude of national trade-related agencies, with overlapping administrative bureaucracies often leading to delays in obtaining certificates of origin or securing necessary customs inspections.

Why trade matters to Ethiopia

Since the early 1990s, Ethiopian governments have launched extensive policy reforms to make the economy more market driven. In 2003, the country began talks to join the World Trade Organization (WTO), a process the government hopes to conclude by 2020.

Using trade to drive faster growth is essential to Ethiopia’s aspirations to join the ranks of middle-income states by the year 2025. Over the past 15 years, the value of Ethiopian exports increased by 549%. Nevertheless, even faster import growth has led to a worsening balance of payments deficit, making the country’s competitiveness in international markets an urgent priority.

Most of Ethiopia’s leading exports have a large number of potential competitors. For agricultural products in particular, such as coffee, sesame and beans consumer-driven preferences are becoming more important. These consumption trends demand a high degree of export competitiveness overall, as well as the infrastructure for testing and traceability that Ethiopian producers will need to access lucrative niche markets such as organic food.

Key recommendations to lower trade obstacles

To date, ITC's NTM Surveys have been implemented in over 65 developing and developed countries with nearly 30,000 interviews with trade companies. More than collect data, the aim is to create a powerful instrument to help developing measures that reduce trade costs by lowering the obstacles that businesses face.

The NTM Survey in Ethiopia interviewed 231 Ethiopian trading companies. Discussions among national stakeholders led to a number of policy recommendations:

- Comprehensive quality improvements in national production are key

To sustain the competitiveness of current exports as well as to achieve successful product diversification in the future, a comprehensive approach to quality improvements is needed for Ethiopian products to match international quality standards or requirements. - Further monitoring and transparency with regard to trade procedures

To achieve higher quality in production, it is necessary to disseminate knowledge of standards and product regulations to Ethiopian businesses. Trade procedures can be perceived as too lengthy because the processes are not fully understood. Access to information is thus a key factor to overcome trade challenges. Higher transparency together with simplified administrative procedures would significantly reduce trade costs. - Training is key to boost competitiveness

Investment in laboratory infrastructure and training is crucial to obtaining international accreditation for the laboratories that provide the conformity assessments goods need to access foreign markets. - Further institutional coordination to facilitate trade

An inter-agency mechanism with focal points from different agencies would help facilitate trade by coordinating and harmonizing regulatory reforms in addition to leading consultations and informational outreach campaigns.