Green competitiveness

Extreme weather patterns are threatening small businesses who face potential crop failures, damaged infrastructure and disrupted logistics, as well as new standards and regulations that raise technical barriers and compliance costs.

We help our clients and partners see how climate is likely to change in the future, the effect this will have on value chains, and how to prepare for future uncertainties. We boost the resilience of small businesses and value chains and support policy makers, business support organizations (BSOs) and the private sector as they adapt.

We also help our clients and partners understand risks and quantify impact, taking account of sector and geographic vulnerabilities. Finally, we support the process of adapting infrastructure, appropriate technologies, systems and processes to cope with the changes companies are already experiencing.

|

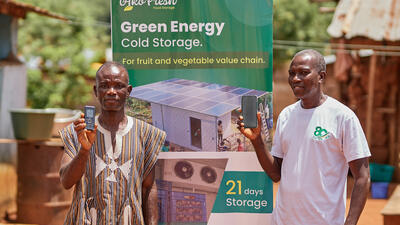

ITC provides small businesses with capacity building on resource use and circular production practices, and links them to those in business ecosystems to innovate, access technologies, services and markets. ITC also develops thought leadership on how policy makers and BSOs can better support micro, small and medium-sized enterprise (MSMEs) in the transition to a circular economy. Circularity offers an opportunity to transform economies so as to reduce waste, circulate resources and regenerate nature. A circular economy can help reduce pollution, emissions and waste as well as increase jobs and prosperity. Circularity also offers small businesses the chance to reduce production costs and increase productivity, and boost innovation around new products and services. ITC promotes nature-positive practices in international value chains and enables businesses to innovate and implement new business models. Nearly half of the global population relies on natural resources and ecosystem services for their livelihoods. Protecting and restoring biodiversity and other natural capital is essential for maintaining incomes, livelihoods and food security into the future. Small businesses can play a key role in reversing biodiversity loss by shifting from business as usual to green business practices. |