Blog: Strengthening African value chains in medical supplies

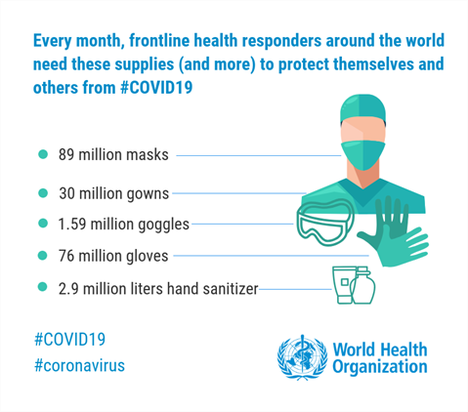

On 3 March, the World Health Organization published estimates that the global production of personal protective equipment would have to ramp up by 40% to meet the surge in international demand¹. Breaking the numbers down to the regional level implies that Africa alone needs 15.3 million masks, 5.2 million gowns, 273,300 goggles, 13.1 million gloves and half a million litres of disinfectants every month.

Africa’s import dependency

The world supply of personal protective equipment is concentrated: four countries – China, the United States, Germany and Malaysia – account for half of global exports. Africa sources predominantly from the European Union (EU) and China. The top five exporters per product together account for three-quarters of African imports.

Figure 1: African imports of medical supplies

Source: ITC Trade Map.

Note: textured part = export ban or restriction. HS codes: Disinfectants

– HS 380894 and HS 380840, Gloves – HS401511, Goggles – HS900490, Masks with

filters – HS 902000, Gowns – 621010. Data is a weighted average of 2014-2018

direct and mirror trade reports.

Some of the key suppliers of health products to Africa have recently introduced export restrictions, complicating the continent’s access to these essential materials. Access to goggles is particularly difficult as on average, 76% of African imports are subject to temporary trade measures. As a response to these shortages, African countries could consider ramping up regional production by adding value to available inputs and by cooperating with regional and global partners.

Building up regional supply capacities in medical products

Currently, only one in six litres of Africa’s disinfectant imports come from regional suppliers. By strengthening regional and global cooperation, this share could grow.

Disinfectants require three inputs: ethanol diluted with distilled water, glycerine, and plastic bottles. Africa already produces ethanol, plastic bottles and caps in sufficient quantities. Providing nearly half a million bottles and caps corresponds to a fraction of Africa’s monthly exports of these products (0.2% and 0.1%), with Egypt and South Africa being the main suppliers. Likewise, the required 374,000 litres of ethanol constitute only 1.5% of the continent’s current monthly exports.

Local glycerine production, however, might be insufficient to meeting the requirements for disinfectant production, calling for a global sourcing strategy in the short run². South Africa, the continent’s only net exporter of disinfectants, sources glycerine mostly from Malaysia and Argentina. An alternative supplier could be Germany with an unrealized export potential for glycerine of $2.9 million to South Africa, and $6.7 million to all Africa.

Figure 2: Potential suppliers of inputs used in the production of disinfectants

Source: Trade Map, Export Potential Map and value chain methodology.

Note: price estimate for ethanol — $2.06 per

litre, for glycerine — $0.63 per litre

For surgical gloves, Africa currently relies almost entirely on imports from non-African suppliers. Malaysia, China and India account for 84% of total imports. While surgical grade gloves can be produced using different types of materials, the most common one is latex. Some African countries have abundant rubber resources and could envisage dedicating some to the production of gloves. By using less than 1% of its monthly exports of latex, Côte d’Ivoire could produce the 13 million gloves that African health responders require each month to face COVID-19. Ghana and Cameroon also have relevant exports of latex but currently do not export any surgical gloves.

A regional response to global supply shortages

In times where the demand for personal protective equipment is increasing sharply, Africa may decide to reinforce regional value chains and local value addition to help scaling up the global supply of these products. This would also contribute to building the region’s resilience against pandemics like COVID-19. Many of the ingredients for a regional strategy in this direction are already in place – and the international community can help leveraging them.

¹ Graphic: https://twitter.com/WHO/status/1235118130055147520?s=20

² In the medium run, Africa may envisage investing into technology for the transformation of its plant- or animal-derived triglycerides into glycerol, keeping in mind though that the purification process is costly https://en.wikipedia.org/wiki/Glycerol#cite_note-Ullmann-6.